Content

- How to Correctly Prepare Deferred Revenue Journal Entries

- Cash vs Accrual Accounting: Speaking The Language of Business

- Is accrued revenue an asset?

- What is unearned revenue on a balance sheet?

- Is unearned revenue a liability?

- What Are Prepaid Expenses/Prepaid Revenues & How Are They Reported on the Balance Sheet?

Since the actual goods or services haven’t yet been provided, they are considered liabilities, according to Accountingverse. Revenue in Salesforce consists of billing to customers for their subscription services. Most of the subscription and support services are issued with annual terms resulting in unearned sales.

- Recognizing deferred revenue is common for software as a service and insurance companies.

- It illustrates that though the company has received cash for its services, the earnings are on credit—a prepayment for future delivery of products or services.

- XYZ sells a 12-month policy for $1200 and receives the money January 1st.

- He makes an adjusting entry where he debits the unearned revenue account $500 and credits the service revenues account $500.

- As the papers are delivered, the liability decreases and the newspaper’s income increases.

Though accrued revenue and unearned revenue are confusing to many, they couldn’t be more different. Accrued revenue represents revenue that you have earned and for which you are yet to receive payment. Unearned revenue, also referred to as deferred revenue, refers to payments you have received for services you are yet to render. Revenue recognition principle –Revenue is recorded in the same accounting period it is earned under therevenue recognitionprinciple. Once you deliver the product or service, that revenue qualifies as earned. Unearned revenue is always listed as a liability on a company’s balance sheet.

How to Correctly Prepare Deferred Revenue Journal Entries

Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a customer for products or services that will be delivered at some point in the future. As a result, the electric utility will have up to one month of expenses without the related revenue being reported. Therefore, at each balance sheet date, the utility must accrue for the revenues it earned but had not yet recorded. This is done through an accurual adjusting entry that debits a balance sheet receivable account and credits an income statement revenue account. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account.

Unearned revenue is actually a current liability, or a short-term liability. Noncurrent liabilities represent a long-term liability like loans, rent, or other lease obligations that last longer than a year. Unearned revenue indicates the intention to perform work for the advance payment within a closer time frame, typically within the next several months or less. Accounts receivable are considered assets to the company because they represent money owed and to be collected from clients. Unearned revenue is a liability because it represents work yet to be performed or products yet to be provided to the client. Once the project is delivered, an adjusting entry must be made.

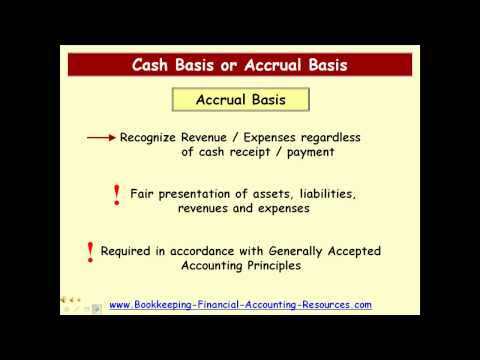

Cash vs Accrual Accounting: Speaking The Language of Business

This entry books the money received as unearned revenue and recognizes the cash received. Every month, once James receives his mystery boxes, Beeker’s will remove $40 from unearned revenue and convert it to revenue instead, as James is now in possession of the goods he purchased. At the end of the six months, all unearned revenue has converted into revenue, since all money received accounts for the six mystery boxes that have been paid for. A subscription accounting firm offers monthly services for $400. Outside of payroll, the accounting firm pays $1200 annually in expenses to service this contract.

The Financial Accounting Standards Board and the International Accounting Standards Board are two independent standard-setting entities in the field of accounting. The two entities created the ASC 606–a 5-step model for recognizing unearned where does unearned revenue go revenue. ASC 606 went into effect December 15, 2017, and it established a standard method by which companies record revenue in customer contracts. ASC 606 is especially impactful for companies that sell services rather than goods.

Where does unearned revenue go on a balance sheet?

Unearned revenue is listed under “current liabilities.” It is part of the total current liabilities as well as total liabilities. On a balance sheet, assets must always equal equity plus liabilities. Both sides of the equation must balance.